From Binance to a New Era

Historically, Binance has been the default gateway for users entering crypto; to purchase tokens, either via a CEX or peer-to-peer, and then staying to trade on their perpetual exchange. The stack is integrated and easy to use, but it is centralised, permissioned, and opaque.

ZKP2P challenges this model, offering a decentralised, fast, and permissionless fiat onramp that leverages zk proofs and focuses on privacy. When paired with Hyperliquid, it forms a fully on chain alternative that can directly compete with the Binance behemoth.

P2P: Centralised vs Permissionless

Binance P2P is branded as a peer-to-peer exchange but you need to have:

- A verified Binance account (KYC)

- Ad approval from Binance

- Your funds held in their custody

- Trust them to facilitate dispute resolution

- Waiting for seller to be online before receiving your crypto

As a seller, you have to be online 24/7 to keep your reputation positive and release funds quickly, you pay a fee to post an advert, and your funds are held in Binance custody. As a buyer, you need to pass KYC for the best prices and sizes, and are at the whim of the seller being online to release the funds to start trading.

On the other hand, ZKP2P is a permissionless, non custodial, smart contract based protocol:

- You do not need an account, just a wallet

- There is no approval process

- No reputation to market make

- Uses zero knowledge proofs to confirm payments

- Funds are released automatically

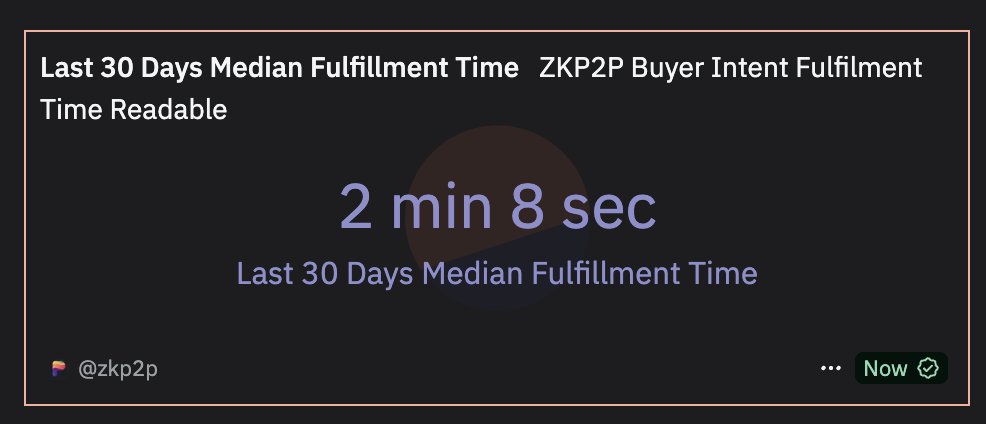

As a ZKP2P seller, you can sell and create a vault without approval, earn outsized yield while you sleep, and have full control over your funds. As ZKP2P buyer, you don't need to pass additional verification, your time to get your crypto depends on how fast you can send your payment which currently averages 2 minutes and 8 seconds in the last 30 days.

A similar comparison can be made with Binance Perps and Hyperliquid. Binance Perps requires:

- KYC

- Custodial margin account

- and is subject to be shutdowns, frozen, or banned regionally

In contrast, Hyperliquid is:

- Fully onchain

- Self custodial

- Comparable funding rates

Building the Onchain Stack

Hyperliquid and ZKP2P are both starting to become more composable within DeFi ecosystems. The former through products like hwHLP, bringing the yield bearing HyperCore asset to HyperEVM, and the latter through 1-click onramps and bridging, and vaults being built on top. They're accelerating the future of a modular, permissionless financial stack where access and liquidity can flow freely. Both protocols are front end agnostic, enabling others to plug into the same infrastructure and fostering ecosystem development and innovation.

Getting started with trading on Hyperliquid with ZKP2P is as much easier than getting started with Binance. You can go from your fiat payment app to the casino within 5 minutes:

- Go to zkp2p.xyz and signal your intentChoose your amount, currency, and payment provider

- Send your fiat to the counterparty through your payment app

- Generate the proof using the PeerAuth extension (mobile soon™)

- Complete your order and bridge to Hypercore

- Open your perps position on Hyperliquid

In the full journey, you never lose custody of your funds, there is nothing locked up, there is no extra KYC or reliance on corporate infrastructure.

You Don't Need Permission

Centralised platforms are coming under increasing pressure to follow regulations, many countries are cracking down to restrict access, disable features, or exit entire markets. Escrow and fraud are becoming rife in peer-to-peer platforms, especially on Telegram and when platforms rely on reputation as opposed to code.

Self custody, privacy, and permissionless access are no longer niche preferences for users, it is a baseline expectation for them. ZKP2P and Hyperliquid are perfectly positioned to meet this expectation. They offer a future where the user controls the flow of fiat <> crypto <> perps without a middleman.

Everyone sees the opportunity of being onchain, and everyone wants a piece of the DeFi pie. With talk of Walmart and Amazon exploring stablecoins, and Robinhood tokenising stocks, it's clear that TradFi giants are circling.

ZKP2P and Hyperliquid aren't just alternatives to Binance, they're how crypto was meant to work; trustless and modular infrastructure that doesn't need unnecessary verification or account logins. They're going to be the next evolution in how users onboard, trade, and interact onchain.

You don't need to ask for permission.

You don't need to lose custody of your funds.

The CEX-free stack is already live, and can only get better.